Last year Auckland council announced a Proposed Air Quality Bylaw, this drew an editorial from the Herald and concerns from us and others as to where the facts and figures came from. Bernard Orsman also did a article entitled “City plan spells end for old flames” and “Plan to ban open fireplaces affects thousands of homes”

Last year Auckland council announced a Proposed Air Quality Bylaw, this drew an editorial from the Herald and concerns from us and others as to where the facts and figures came from. Bernard Orsman also did a article entitled “City plan spells end for old flames” and “Plan to ban open fireplaces affects thousands of homes”

the committee is due to meet in February on their web site the council provides the governing body report and an article about managing Auckland’s air quality .

the questions we asked were

1) All research which has been conducted into this matter – showing location and time frames over which this has been monitored.

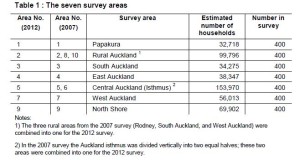

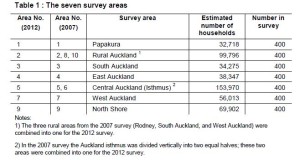

Their response :The Herald article mentions the number of households that would be affected by any proposed ban of older wood burners and open fires.The information on total number of households using wood for home heating was taken from the 2013 census. The proportion of wood burners using old wood burners (pre 2005) and open fires was then calculated using information from the 2012 Auckland Council Heating Survey (attached).1. 2012 Auckland Council Home heating survey result

Our response :in the report the word assume features 14 times and “estimate” 64 times , they conducted the survey based on responses and not actual emission readings . the data was obtained from

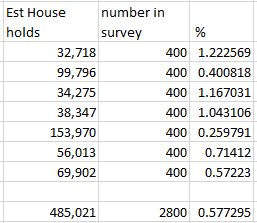

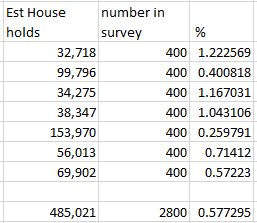

In terms of % this is what they surveyed

In terms of % this is what they surveyed

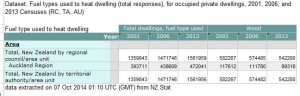

this is the area they surveyed

Now just by applying logic you will find more people in the rural areas using open fires than in the central city .

In total just over half a percent was surveyed of which 50% lived outside the isthmus area.

The isthmus area has the greatest population and has greater pollution from other sources eg. vehicles

It is of note that there appear to be actual measurements and pollution readings.

2) Evidence that the domestic fire places are to blame for deaths in Auckland as implied by Councillor Darby.

Their response :The Herald article also mentioned the number of people affected in Auckland by discharges of fine particulate (or PM10) from domestic home heating information. The number of people affected by PM10 from domestic home heating was taken from the evidence of the health effects of indoor fires as well as all other sources of PM10 emissions can be found in the following the independent report: “Updated Health and Air Pollution in New Zealand Study 2012 ” this report will also answer questions 6 and 7.

HAPINZ_Update_Vol_1_Summary_Report

Our response : The word assume appears 31 times in this document and Estimate 141 times.

“The authors estimated that air pollution from all sources in New Zealand was responsible for approximately 1,400 premature deaths per year, of which 1,100 premature deaths were attributed to anthropogenic (human-caused) sources” this statement could easily cover deaths from smoking .There appears to be no evidence that wood fires are responsible for or contribute to these deaths 2.1 discusses these issues along with “sources such as burning coal, oil, wood, petrol and diesel in domestic fires, motor vehicles and industrial processes”

HAPINZ_Update_Vol_2_Technical_Report

Our response : The word assume appears 34 times in this document and Estimate 132 times It appears that this report relates to NZ generally and not to the specific issues of wood burning in Auckland . Health figures are also not available for Auckland. Christchurch and Auckland have vastly different demographics and the issues and problems there cannot be applied to Auckland.

3) Research which shows that fireplaces since 2005 emit less particles than those prior to 2005, please supply details of makes and models.

Their response :The New Zealand Government introduced the National Environmental Standards for Air Quality (AQNES) in 2004. The regulation set national standards for air quality and introduced the new design standard for wood burners; they had to meet new emission and efficiency standards from 2005 (discharge less than 1.5gm/kg of particle for each kilogram of wood burnt and have a thermal efficiency of not less than 65 per cent). The AQNES required all models of wood burners sold to be tested to ensure they meet these standards, a list of wood burners that meeting the standards is kept on the Ministry for the Environment (MfE) website. (see attached National Environmental Standards for Air Quality)

Prior to the AQNES there was no national standards for the emission levels or thermal efficiency, however some testing has been carried out on older wood burners. (see attached Real Life Emissions Testing of Pre 1994 Woodburners in New Zealand)

Our response : So why the 2005 cut off when quite clearly some pre 2005 wood burners are complaint why not place a specification on types. 11 years passed between 1994 and 2005 and those who installed their wood burners in the early 2000’s may well have compliant burners.

4) Comparisons of fine particle pollution in Auckland to other cities, at what height does it occur, how long does it linger or disperse, is our isthmus location an attribute which makes air linger?

Their response :The council does not keep records of air quality monitoring undertaken in other areas of New Zealand. However a summary of all ambient air quality monitoring undertaken in New Zealand can be found on the Ministry for the Environment website.

Whilst other cities in New Zealand such as Christchurch and Rotorua have more incidences of air pollution caused by fine particulates (PM10) the Resource Management (National Environmental Standards for Air Quality) Regulations 2004 requires all regional councils to meet the limits on the number of exceedances of the PM10 standard as specified in the regulations. Areas such as Christchurch and Rotorua have a higher level of historical exceedances of the PM10 standard and have more time than Auckland to meet the requirements of the regulations.

The monitoring undertaken in Auckland is done using fixed monitoring sites that sample the air close to the ground; they measures the air that people are exposed to and breathe. Exceedances of the PM10 standards in Auckland and other areas occurs during periods of cold and calm weather during winter when the pollution from domestic fires collects under temperature inversions caused by the conditions.

Being particulate matter the time it takes for PM10 to settle out will depend on climatic conditions such as wind speed and direction. On very still evenings it is likely that PM10 will remain near the fires that produce the particulate. Exceedances of the PM10 standard in the last 5 years have been found at monitoring stations in Takapuna, Pakuranga and Khyber Pass.

9. Exceedences to Date Auckland Council 2005-2012.

Our response : the spread sheet actually mentions how long and why these limits were exceeded at the time – House fires etc, the exceedence is minimal considering the circumstances.

5) Consideration to existing usage rights, traditional .. going back to the year dot.

Their response :There are no existing use right for any fire if it causes a health nuisance because of large levels of particulate emissions. The AQNES allows councils to make bylaws that are more stringent than the regulations.

Our response : But why make by laws when they are not requires and will not have any impact on the problem you are trying to solve or a problem which does not exist.

6) The dangers of open fire/ firebox pollution as opposed to industrial, vehicle pollution and cigarette smoking.

Their response :The Updated Health and Air Pollution in New Zealand Study (HAPINZ) (attached) looked at health effects and included a number of New Zealand and overseas studies on health effect from fine particulate. There are a number of studies that have looked at health effects from wood smoke compared to other combustion particles i.e. vehicles, cigarettes smoke etc.

(Air pollution combustion emissions: Characterization of causative agents and mechanisms associated with cancer, reproductive, and cardiovascular effects, Woodsmoke Health Effects: A Review, first published in Inhalation Toxicology 2007)

Our response : But how does this relate to Auckland????

7) Who conducted the research, how was it verified, which standards were applied.

Their response :The HAPINZ report was undertaken on behalf of the Health Research Council of New Zealand, Ministry of Transport, Ministry for the Environment, NZ Transport Agency and was based on Epidemiology studies similar to that used to determine the effects of cigarette smoke. If you have any question about this study please contact the authors of the HAPINZ report.

The following reports have been used as to support the proposed Air Quality Bylaw. These are also attached to this response for your reference.

• 2012 Home Heating Survey Results (TR 2013/011), April 2013as above

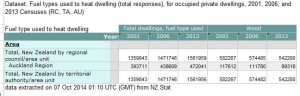

• Census output – wood use in Auckland 2001 to 2013

• Statement of Proposal – Introduction to the Air Quality Bylaw 3. StatementofProposal introduction of the air qua

It would appear from this docuemtn that the cause of our pollution is not from domestic fires, but we guess its easier target the rate payers and residents that the industrial sector.

• Updated Health and Air Pollution in New Zealand Study – March 2012, volumes 1 and 2.as discussed above

• National Environmental Standards for Air Quality (Update June 2011)4. National Environmental Standards for Air Qualit

this is the statute . there is no evidence that we do not comply with statute . ther is a design standard referd to in the statute at (23) , the statute states that these wood burners should not be installed after 1 September 2005 it does not say they need to be removed.

• Domestic Fire Emissions 2012: Options for Meeting the National Environmental Standard for PM10. (TR 2013/022)5. domesticfireemissions2012optionsformeetingnatio

this document states “Domestic fires are a major source of particulate in the Auckland region, contributing to 41 per cent of total annual PM10 emissions and 43 per cent of PM2.5 emissions in 2011 (Auckland Council, 2012a). Levels are even higher during winter, with domestic fires accounting for 70 per cent of daily PM10 and PM2.5 emissions on a typical winter’s day. The annual social cost of health effects associated with domestic fire pollution is estimated at $411 million for the Auckland region ($NZ as at June 2010, Kuschel et al., 2012).” What we are looking for is the evidence upon which that statement is made.

• Air Quality Domestic Options – Cost Benefit Analysis 2012 (TR 2013/0X29)6. airqualitydomesticoptionscostbenefitanalysis201 the word assumption appears 24 times in this 44 page document and Estimate 27 time. there is no REAL data. There is no analysis of what is in the air specific to Auckland

• Real Life Emissions Testing of Pre 1994 Woodburners in New Zealand this is pre 1994 there is no evidence that wood burners 1994-2005 are non compliant .

• Clean Healthy Air for All New Zealanders: The National Air Quality Compliance Strategy to Meet the PM10 Standard, MfE, 1 August 2011.Download PDF (945 KB) Ministerial document setting he limits for air pollution, we have so far not seen any evidence that Auckland exceeds these limits

• Exceedances to data: Auckland Council 2005 – 2012 as discussed above the excrescences are due to exception circumstances

• Woodsmoke Health Effects: A Review, first published in Inhalation Toxicology 2007 10. Wood Smoke Health Effects A review first publi this is a document wEstimate 28 times there si no REAL data hich speaks of the dangers of air pollution , we do not dispute that, we want to see factual evidence that there is air polution n Auckland caused by wood burners.

• Air pollution combustion emissions: Characterization of causative agents and mechanisms associated with cancer, reproductive, and cardiovascular effects 11. Air pollution combustion emissions (health).pd this is a document which speaks of the dangers of air pollution , we do not dispute that, we want to see factual evidence that there is air polution n Auckland caused by wood burners.

• ARC – estimation of Domestic Fire Emissions in 2006.12. ARC Estimation_of domestic_woodburner_emission note the word estimate appears in this 59 page document 138 times. it even appears an additional time in the title . The word assume or derivatives there of appears 105 times – Our question How factual is a document based on estimates and assumptions ?

User Guide NES Air Quality

ARC_SA_Presentation_GNS_9_May_2008 If this report was an account it would be thrown out due to its data being over 7 years old , the cover photo loos suspiciously like morning fog as opposed to pollution.

From: Grace Haden

From: Grace Haden Last year Auckland council announced a

Last year Auckland council announced a

The law society have a

The law society have a

equity law as being inthe building and when our director had close relationships with the law firm it appeared to be a law firm .

equity law as being inthe building and when our director had close relationships with the law firm it appeared to be a law firm .

Transparency International are running an excellent campaign called

Transparency International are running an excellent campaign called

Delegation, calculation of penalties and applying penalties to Rates A dogs Breakfast

Delegation, calculation of penalties and applying penalties to Rates A dogs Breakfast